SBI’s Customer Information File (CIF) is an exclusive 11-digit number assigned to each account holder of SBI that helps banks track and manage customer-related data efficiently.

You can find this number printed on the front page of the passbook or cheque book, online by visiting the SBI Internet Banking website, calling SBI customer care, or by visiting the bank in person.

Read on to learn more about the SBI CIF number, how it works, finding CIF Number and importance of CIF number in SBI bank account.

What is CIF Number in SBI?

The CIF Number or Customer Information File Number in SBI is an 11-digit code and is the digital passport to your comprehensive banking profile. This unique identifier allows the bank to view customer details – including account photographs, addresses as proof, detailed account summaries, previous loan amounts, transactions, the opening date of the account, and information on Know Your Customer (KYC) data.

The SBI CIF number works like a linchpin against which customer details can be stitched together across SBI bank branches. This aids in customer privacy, stops customer clashes–when two customers have similar information but are not the same and guards against customer fraud.

How Does a CIF Number Work?

The CIF number consolidates all the banking services available to an account holder with a unique identification number using which a bank staff can know what bank services a customer is using.

This unique number also helps bank staff while assisting a bank customer with a product or service.

You can easily find this number on the very first page of your cheque book or passbook.

Where To Find CIF Number?

Almost all banks provide easy access to CIF numbers to their customers by printing them on the passbook or the cheque book.

A CIF number is the key to your relationship with the bank and contains all the information about a bank customer.

Also, even if you have closed the bank accounts or other services to a bank, they can still have that data stored with them.

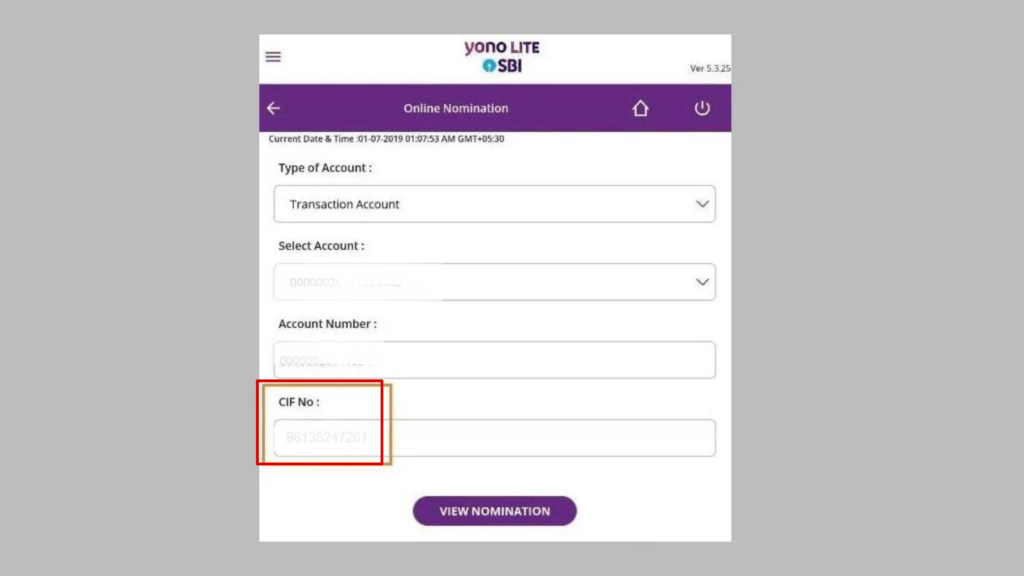

How To Find SBI CIF Number via YONO App?

Here is a step-by-step guide on how you can easily retrieve your SBI CIF number using the YONO app.

1. Download the SBI YONO app from the Play Store or App Store.

2. Open the app once it is installed on your smartphone.

3. Log in using your account details.

4. Navigate to the “Services” tab.

5. Tap on “online nomination”.

6. In the next screen, change the account type to “transaction account”.

7. Your bank’s CIF number will be displayed as “CIF” in the account statement.

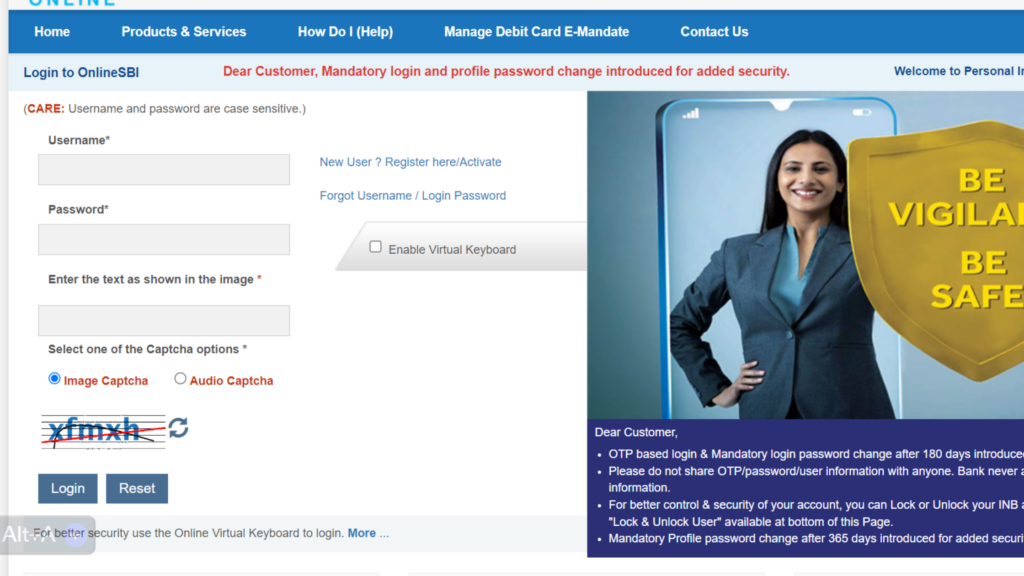

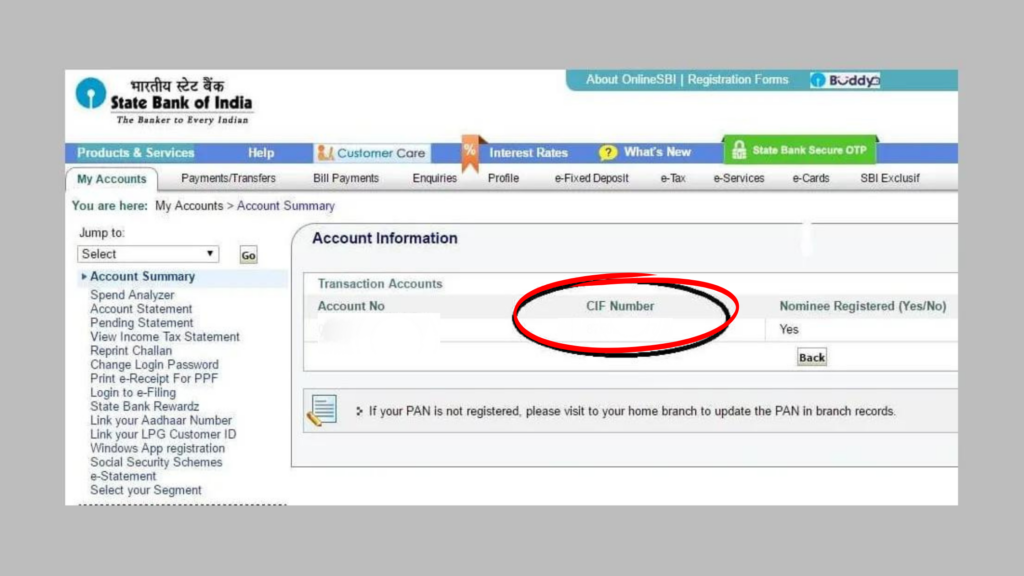

How To Check CIF Number of SBI Online Using SBI Website?

The SBI Net banking is one of the best options to find your SBI CIF number online and it also removes the need to visit the SBI branch for this.

Follow the below steps to find the SBI CIF Number Online using Net banking:

- Visit SBI Online Net Banking and log in with your Username and password.

2. Go to the “My Account” tab and then click on “Profile“.

3. Select “Account summary” from the dropdown.

4. Click on “View Nomination and PAN Details.” Your SBI CIF Number will be displayed on the screen.

How To Check the CIF Number in SBI via SMS?

You cannot find your SBI CIF number directly by just sending an SMS, but there’s a way around it that helps you find this unique number.

You will have to request an e-statement via SMS and once you get the statement, you will find the CIF number printed on it.

But to use this method, your Email ID must be registered with the bank.

Send an SMS to 09223866666 from your registered mobile number with the word ‘MSTMT’ in the subject line.

Patience is key, your e-statement will soon arrive in your inbox in which you can find the CIF number. This small process ensures you access your SBI CIF number with ease.

How To Find SBI CIF Number by Calling SBI Customer Care?

Here’s a step-by-step guide on how you can get your SBI CIF number by calling the customer care helpline:

- Dial 1800112211 or 18004253800 from your registered mobile number to reach out to the SBI customer care helpline.

- Follow the automated call prompts or stay holding to connect with a customer care executive.

- Upon connecting, the executive will ask you for certain account details to verify your identity. Share the required details when requested.

- Once the executive successfully authenticates you as the account holder, they will provide your CIF number.

For a smoother and quicker result, keep your account-related details at hand when you call.

Other Methods To Find CIF Number in State Bank Of India

The CIF number is printed on the Passbook and cheque books providing an easy solution to find your SBI CIF number.

Here are all the ways to find the SBI CIF number.

Passbook

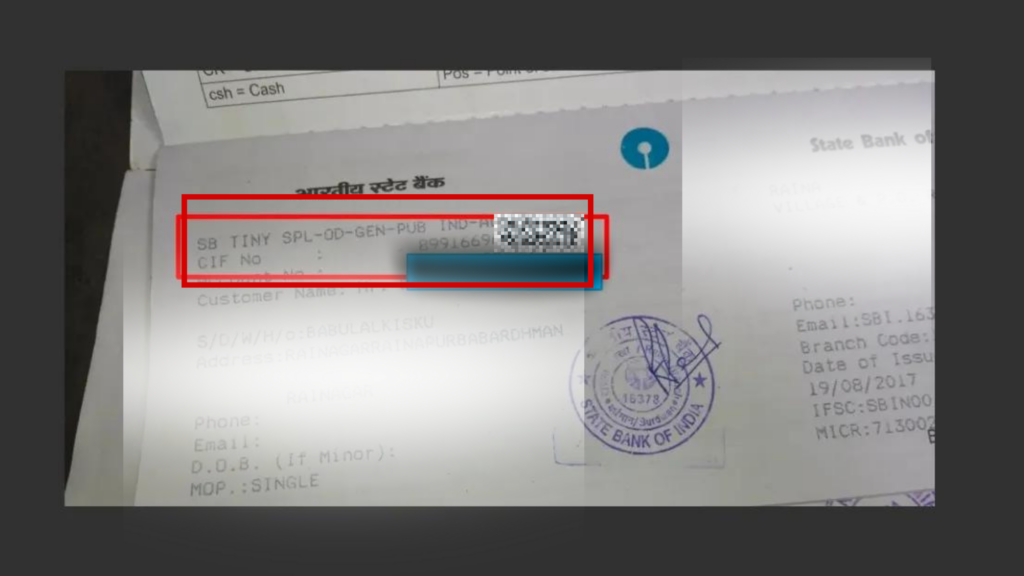

Generally, the CIF number is printed on the first page of your SBI passbook. Check the below passbook picture to identify the CIF number and find out your CIF number in SBI.

Cheque Book

If you already have a SBI cheque book, you can find the CIF number printed on the very first leaf of the cheque book. It also contains other information such as your name, address, PIN code, and your registered mobile number with the bank.

Branch Visit

The other convenient method to find the CIF number in SBI is visiting a branch and asking for help with the CIF number from an SBI bank staff.

The bank staff will verify your identity and provide you with the CIF number.

ATM

Unfortunately, you can’t find out your SBI CIF number using the SBI ATM. We will update the information once the service becomes available for you all.

Importance of CIF Number in SBI Account

The CIF number is of great importance to accessing bank customer’s data and information, especially when there are multiple accounts of customers with the same name. It also helps bank staff distinguish between two different account holders when their names are identical.

Here are some other benefits of a SBI CIF number:

- CIF number protects a bank account holder from fraudulent transactions and ensures that only the authorised account holder with SBI gets access to the account funds and other information.

- This CIF number also makes it feasible for banks to provide better services to their customers. For example, approving a loan or a Demat Account is becoming faster and simpler as all the information is already available with the bank.

- Also, in case you have an inactive or dormant account, the bank staff can get all the required information and reactivate your account with just a simple application.

- It helps banks maintain a virtual locker with all the customer’s information that can be easily accessed by entering the CIF number.

- It helps banks in offering customised and personalised products and services. Also, a bank staff can provide you with tailored offers and suggestions based on your requirements.

- It helps banks decide the Total Relationship Value (TRV) and the Customer Relationship Value (CRV) of a customer.

Since the CIF number contains all the information of a customer therefore accessing it online requires a series of OTPs.

What are the important features of CIF Number in SBI?

The important features of CIF Number in SBI is listed below.

- You Get A Unique Identifier: A CIF number in SBI is a UNIQUE identification number assigned to every individual having a relationship with the State Bank of India. The unique identifier represents all the sensitive information of a SBI customer including account number, identity, and address proofs submitted to the bank and services that you are using with the bank.

- Confidentiality: The CIF number safeguards the confidentiality of the account holder which is only shared with the bank and all the details can be accessed by only the SBI bank staff.

- Verification and Authentication: The CIF number is also used to verify and authenticate transactions and approve loans. The banks also regularly provide loans and other offers based on the services you are using and the CIBIL score.

Frequently Asked Questions on How To Check SBI CIF Number in SBI?

Do you get SBI CIF number of Debit card?

No, you don’t get the CIF number mentioned on the SBI debit card but the letter that comes with the debit and credit cards does have the CIF number mentioned on it.

Is the account number and CIF number the same?

The Account Number and CIF number are not the same, you can have multiple accounts such as savings, fixed, PPF, education loans, home loans, etc, and all these accounts have different numbers whereas a CIF number signifies mapping of all these information.

Are the CIF number and customer ID the same?

Yes, the customer ID and the CIF number are the same in most circumstances.

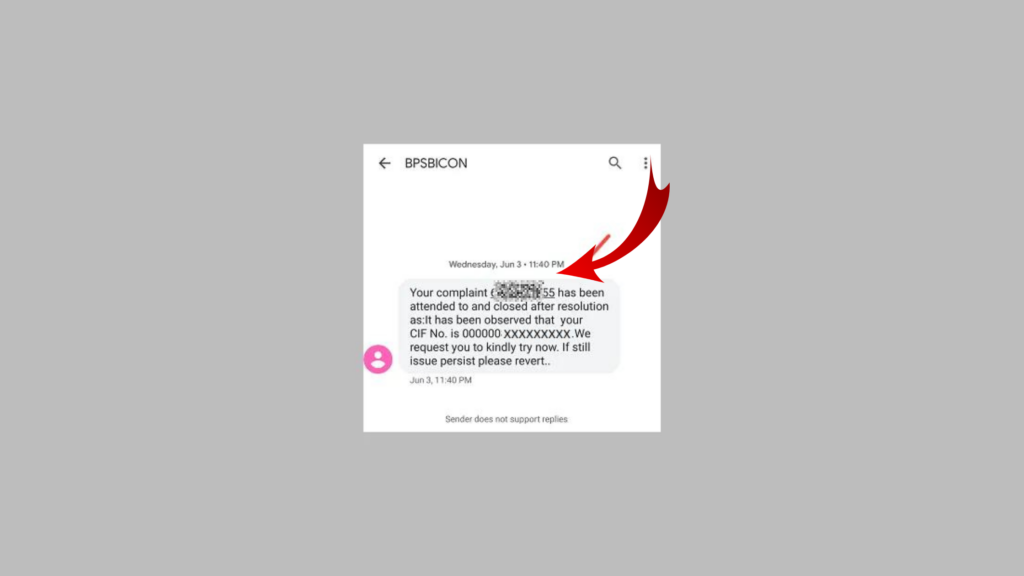

Why is my SBI CIF number invalid?

If your SBI CIF number is showing invalid it means either you have entered your CIF number incorrectly or it has changed.

How long is the SBI CIF Number?

The length of the SBI CIF number is 11 digits.

What is the Full Form of CIF?

The full form of CIF is the Customer Information File.

What details that CIF Contain?

CIF contains all the details of your bank relationship including transactions, account balance, etc., and personal details that include your name, gender, residential address, etc.

Conclusion

Through this article, we have provided all the ways by which you can get your SBI CIF number. From age-old passbooks to state-of-the-art tech options, it’s now easier than ever to find your CIF number easily in seconds.

![SB001 Technical Error in SBI Yono App [100% Solved]](https://bankingvista.com/wp-content/uploads/2024/03/sb001-technical-error-sbi-768x432.webp)