There are two ways to open an SBI savings account – you can open either SBI savings account online using the SBI website or using the Yono APP. The other option includes visiting the SBI bank branch and filling out the account opening form.

You can open an SBI bank account 24/7 without the need to visit a branch. You can open it through the YONO app, internet banking, and mobile banking. A signature will be taken as part of the video KYC procedure.

Once your account is active, you can apply for a cheque book using YONO/Internet Banking/Branch.

You can visit the SBI branch near you to open an offline account. For this, you will have to fill out the application form and attach the required KYC documents.

This SBI bank account opening guide will help you find all the documents required to open SBI savings bank account and the right steps to open the account online and offline.

What is The Eligibility To Open an SBI Bank Account?

The eligibility to open SBI bank account are;

- You must be a citizen of India.

- You have to be eighteen years of age or older.

- For minor accounts, their parents or legal guardian can open the account.

- The applicant must present official identification and evidence of address from the government.

- Depending on the minimum balance requirement of the specific savings account the application has selected, the applicant will have to make an initial deposit after receiving approval from the bank.

Documents Required To Open SBI Account

To open a State Bank of India Account, you must have the following required documents with you.

- Aadhar card

- Mobile connected to Aadhar for one-time passwords

- Pan card

- Recently scanned photo image, up to 1 MB in size

- Scannable address proof of address (POA) image, up to 1 MB in size

- Scannable signature, up to 1 MB in size

| Proof of identity | Aadhar, Driving license, Voter’s ID card, Passport, etc. |

| Proof of address | Aadhar, Driving license, Voter’s ID card, Passport, etc. |

| Other important documents | Permanent Account Number (PAN) card, Form 16 if PAN card is not available and Two latest passport size photographs. |

There are two ways to open SBI bank account online:

- Insta savings account without SBI branch visit. (check here for Insta plus savings account)

- Digital banking account with SBI branch visit.

The fastest, safest, and paperless method of opening an account in SBI is using SBI website or Yono App to open an Insta savings account.

With a digital savings account, the user can access banking services, such as instant transfer, phone banking, SMS banking, and more.

How To Open SBI Savings Account Online Through the SBI Website?

To open an SBI savings account through the SBI website, follow the below steps:

Step 1: Open the State Bank of India’s official website.

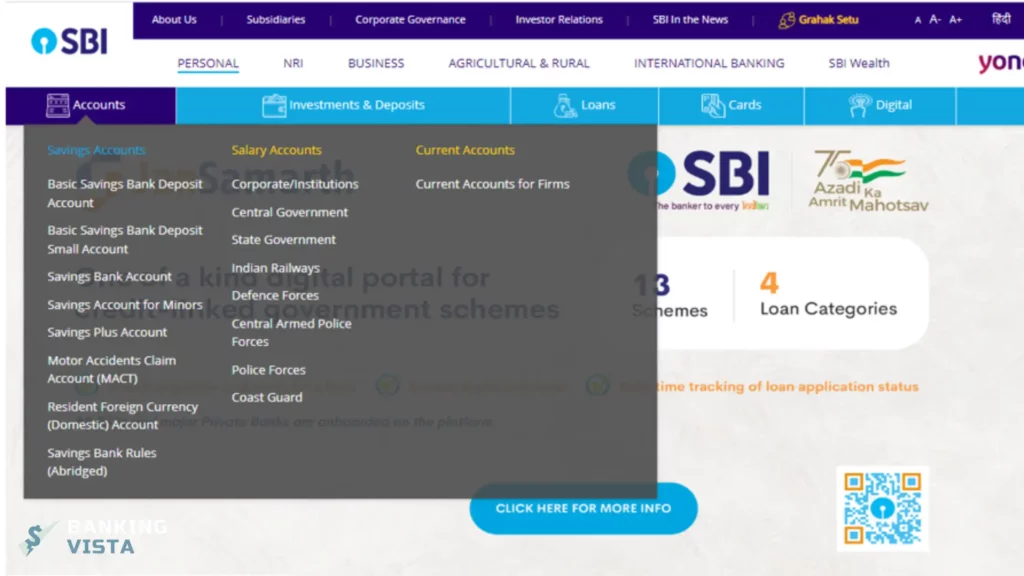

Step 2: From the Accounts section, choose the Savings Account option.

Step 3: Click on the Apply option.

Step 4: Fill in the required details on the application, such as your name, residence, and birthdate.

Step 5: Select Submit from the menu.

Step 6: Bring the necessary KYC documentation to the branch after completing this process.

Step 7: The account will be opened in three to five working days.

How To Open a SBI Account Online Using the YONO App?

To open a savings bank account in SBI using Yono APP, follow the below steps:

- Install and Open SBI YONO app on your smartphone.

- Click on New Customer.

- Select Open Insta Savings Account.

- Click on the open with Aadhaar using the e-KYC option, then provide your email address and mobile number on the following screen.

- After completing the OTP verification process, input your PAN number to accept the declarations.

- At this point, enter your personal information and take a selfie to upload.

- Provide the following information: your annual income, educational background, religion, marital status, data about your parents, kind of occupation, and nominee information.

- Select your nearest home branch, read and accept all the terms & conditions, and click on submit.

- Enter the OTP you receive on your registered mobile number.

- Choose your card type and enter your ATM cum debit card details.

- The account number and CIF number for your SBI account will be generated automatically.

- Congratulations! Your SBI account is opened and you will receive the temporary username and password on your registered mobile number with the bank for internet banking and YONO app login.

Points To Be Noted –

- You must be a new customer of SBI without any previous relationship with the bank.

- You must have an Aadhaar Card and PAN Card before applying for a new bank account.

- You don’t have to maintain a minimum balance or monthly average balance as it’s a zero-balance account and the maximum balance you can keep in your account is Rs 1 lakh.

If you are logging in to your SBI Account for the first time using YONO App and seeing an error message No Accounts Mapped for this username, then read our troubleshooting guide on how to solve No Accounts Mapped for this username in SBI.

How To Open SBI Bank Account Offline?

Even though you can open an SBI savings account online, most account openings or account conversions from an existing online account to a full-fledged savings account will still require you to visit an SBI branch.

Here’s how you can open an SBI savings account online:

- Fill out the SBI Savings Account form when you visit the SBI bank.

- Fill in your basic information and select the account you want to open.

- Attach copies of your self-attested PAN and Aadhaar cards.

- Submit the form with a demand draft or deposit slip if you are paying with cash as an initial deposit, and other documents for your identification, income, and place of residence verification.

- Once your documents are verified by the bank officials, your account will become active in 3-5 business days.

SBI Nomination Facility

All bank accounts, safe deposit vaults, and items in secure custody are eligible for nomination. Accounts that are opened as single, joint, or sole proprietorship businesses are eligible for nomination.

One nominee may be made exclusively in support of one individual. However, in jointly owned locker accounts, nomination in favor of two or more individuals is allowed with mutual agreement.

The account holder can make, modify, or cancel nominations at any point in their lifetime. All account holders must sign the request and provide a witness when making a nomination, cancellation, or modification.

Only the depositor’s death, or the deaths of all depositors in the case of joint accounts, gives the nominee the right to receive payment from the bank. If a depositor or deposits do not desire to nominate someone, this should be included on the account opening form and fully signed by the depositor or deposits.

SBI Welcome KIT

When you open an Insta savings account with SBI, you will be provided with a SBI Welcome KIT which includes the following things:

- A SBI Debit card.

- A cheque book with ten leaves.

- Passbook.

- You will get the ATM PIN through a separate post.

Frequently Asked Questions (FAQs)

Is there a free SBI savings account?

Yes, opening a savings account at the State Bank of India is free of charge. The account holder will not be charged anything.

Is it possible to open multiple SBI savings accounts?

Yes, you can have many savings accounts tied to one customer ID, and all accounts will work together.

Can You open SBI bank account with a zero balance?

Yes, you can open SBI bank account with a zero balance provided you have an Aadhaar card and PAN to open the account online.

How many days does opening a SBI savings account take?

You can open an SBI savings account in 2 minutes, but the account activation could take three to five business days.

What is the minimum balance for opening SBI bank savings account?

The Average Minimum Balance (AMB) for SBI savings accounts in rural, semi-urban, and metro areas are Rs.1000, Rs.2000, and Rs.3000, respectively.

How can I check my SBI account balance on Mobile?

To check your SBI bank account balance on mobile, send an SMS, type ‘BAL” and send it to 09223766666 from your registered mobile number.

Is Aadhaar mandatory to open an SBI savings account?

No, as per the current bank guidelines, an Aadhar card is not mandatory to open SBI savings account. You can use other documents such as a Voter ID card, Driver’s license, etc. in place of an Aadhar card.

Is a PAN card a mandatory document for SBI savings account opening?

Yes, a PAN card is a mandatory document for opening savings bank accounts in all the banks including State Bank of India) SBI.

Final Thoughts

Customers of SBI Account can choose from a wide range of banking services. Quick utility bill payments through net banking are among the features offered by the State Bank of India Saving Account, the biggest bank in the nation in terms of landing.

One of the most alluring aspects is that SBI branches are easily accessible due to their widespread locations nationwide.

![No Accounts Mapped for this username Error in SBI [100% Solved]](https://bankingvista.com/wp-content/uploads/2024/03/no-accounts-mapped-for-this-username-sbi-768x432.webp)